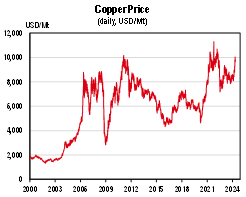

While oil prices, as discussed earlier, are falling, over on the copper desks in the big commodity trading houses it’s all "buy, buy, buy".

Copper prices jumped another 1.5% over the weekend to be up 15% so far this year.

The commodities team at investment HSBC say the surge is the result of a "super squeeze" in supply and demand.

"Underinvestment in copper mines combined with a wave of 'green demand' that is coming from the energy transition, is making the copper market tighter than usual,” HSBC wrote in a note to clients.

Demand for copper has been long regarded as a leading indicator of global economic activity.

High demand is more often a pre-cursor to a global manufacturing boom given it is used in so many industrial processes.

Dr Copper's prognosis on falling demand is generally grim news for the global economy.

The HSBC house view is not unique.

"The copper-intensity of the energy transition means that copper demand is set to be structurally higher for decades to come," it says, noting copper is a key input into electrification, used in transmission lines, electrical infrastructure and vehicles.

It's a big part of the reason BHP is pursuing Anglo American’s copper mines.

The big miners seem to prefer buying others mines than going through all the hassle, risk and cost of developing new ones.

"The projected annual investment spend on copper over the next four years is less than half the nominal spend that occurred at the peak of the last China led 'super cycle', between 2011 and 2014," HSBC says.

On Standard and Poor’s reckoning global copper production is currently around 22 million tonnes a year, well short of the forecasts that 50 million tonnes year will be needed by 2035.

Whether the current price spike is a harbinger of an upswing in the global economic cycle or a narrowly based energy transition story, HSBC says it doesn’t really matter, the supply/demand squeeze will be in place for some time yet and prices are only likely to increase.