Reducing the debt of China's beggared local governments by CNY (yuan)12 trillion ($2.6 trillion) in less than five years sounds impressive but it has been met with serious disappointment by those on the outside looking in – investors, commodity traders and a large chunk of the commentariat.

Certainly, investors on the ASX were disappointed and were tossing their mining shares overboard at the first opportunity this morning.

Most of the big miners like BHP, Rio Tinto and Fortescue slumped 4-to-5% on opening, the juniors like Champion Iron fared worse, down almost 9%.

However, that disappointment may not be shared by regional party officials who are staring bleakly into the abyss of career destroying insolvency, but it has not exactly fired up confidence that China will resume its barnstorming economic growth of not so long ago.

The perception problem is the lack of any direct fiscal adrenaline shot in the package announced after China's National People's Congress (NPC) standing committee wrapped up its week-long meeting on Friday.

The headline of a CNY12 debt swap left many asking what is a debt swap and how that going to get healthy money pumping through the sclerotic financial system?

In its simplest, the plan is clear the slate with local governments - particularly small ones, not the powerhouse like Beijing, Shanghai and Guangdong - cut their hidden debts of CNY14.3 trillion to a more manageable CNY2.3 trillion, with the central government issuing new loans to struggling regional governments in exchange for the problem debt.

It will allow struggling local governments to refinance "hidden debt" onto public balance sheets through to 2028.

As NAB's Tapas Strickland says the debt swap will save local governments CNY600 billion in interest payments over the next five years, freeing up some funds to spend.

"But this wasn't the sort of fiscal stimulus the market was hoping for, to direct money to households to spend," Mr Strickland said.

So, what will be its impact on the economy?

Societe Generale's China economic team notes the debt issuance will not fund new measures and the Ministry of Finance has pledged to contain growth in any new local government debt.

"But the swap will free up fiscal resources and allow local governments to function more normally," SG said in a note to clients over the weekend.

"That is, local government will be much abler to carry out necessary spending, reduce unnecessary fines and penalties, and pay back arrears owed to the private sector."

It's the absence of direct financial support, or any details beyond the debt swap that's disappointed markets.

"China stimulus bazooka misfires" is how Hamad Hussain, a climate and commodities economist at Capital Economics put it.

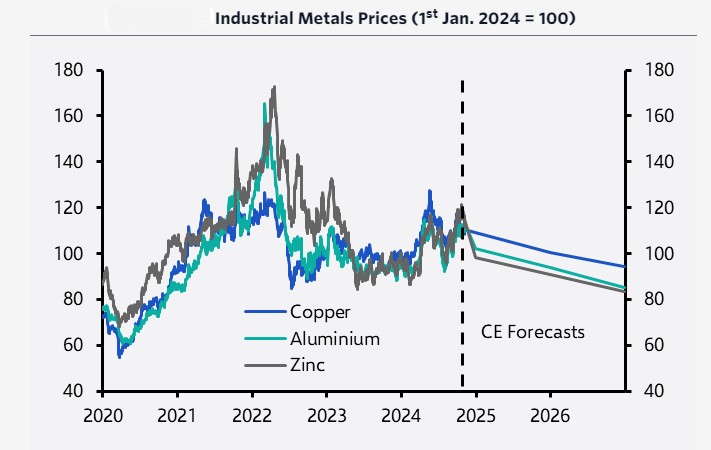

Industrial metal prices all fell immediately after the announcement. That sentiment may well be reflected in share prices of Australian miners this morning.

Mr Hussain said there is still some fiscal support in the pipeline from the Chinese government's push to use up remaining budget funds by the end of this year.

"This could yet provide some support to commodity prices over the next few months, especially if these funds are directed towards large infrastructure projects," Mr Hussain noted.

"That said, the fiscal and monetary stimulus packages launched by Chinese policymakers over recent months have not convinced us to alter our long-held downbeat view on industrial metals prices.

"This is because none of the measures announced so far suggest that there will be a surge in property or infrastructure construction that would substantially change the outlook for China's metals demand.

"More generally, the key point is that the structural headwinds facing China's economy remain unaddressed and, as a result, China's metals demand will slow over the second half of next year and 2026.

However, it should be noted that the 2025 fiscal budget is yet to be framed and Finance Minister Lan Fo'an mentioned that more support for the economy would be forthcoming.

As SG's team points out the Chinese economy is showing more signs of bottoming out, and so there is less rush to top up stimulus for 2024.

Also, there is question of keeping some, actually rather a lot of fiscal firepower in reserve to deal with any Trump contingencies.

"There is still so much uncertainty around Trump tariffs — how much and when," SG wrote.

"Why showing all the cards now? We estimate that raising US tariff rate on Chinese goods from 20% currently to 60% could require RMB2-3tn additional fiscal stimulus to counter."

These are questions not likely to be answered before the next NPC meeting next March.