Companies shied away from listing on the stock exchange last year and those that did mostly struggled to hit their funding targets.

There were 87 new listings in 2022, compared to 191 in 2021, representing a fall of 54 per cent, according to IPO Watch Australia's 'Review of Australia's 2022 IPO Activity Report.'

"Initially there were solid expectations for the year following a record number of listings in the second half of 2021 and a healthy pipeline of companies looking to list in early 2022," IPO Watch Australia Partner Marcus Ohm notes.

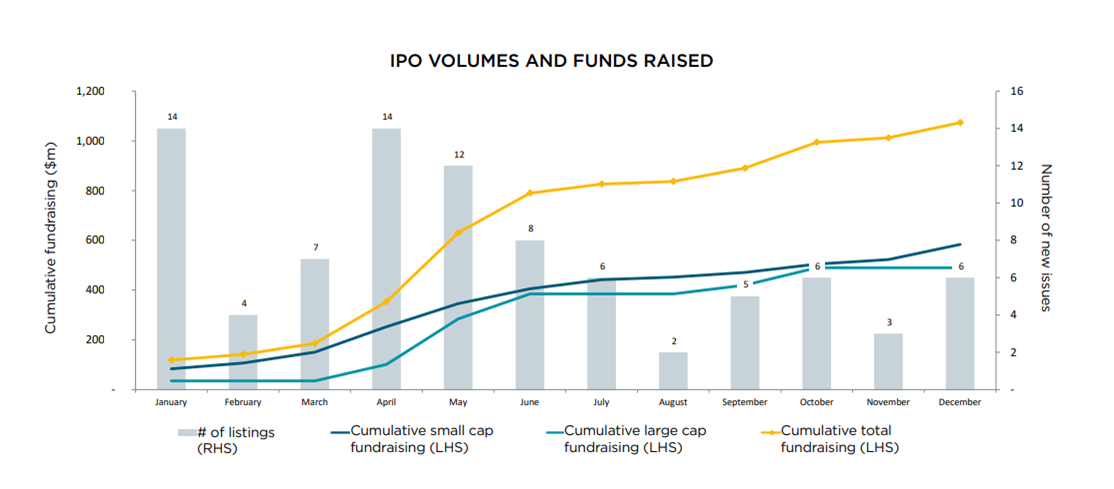

"However, the IPO market all but dried up in the second half of the year with no single month from June onwards recording a double-digit number of listings."

Total funds raised in 2022 reached $1.07 billion compared to the record-breaking amount raised in 2021 of $12.33 billion, the report notes.

"The amounts raised were also significantly below 2020 ($4.98 billion) and 2019 ($6.91 billion). Notably, there were fewer listings in 2020 (74) and 2019 (62) than in 2022, reflecting the contributions from large cap listings in these prior years."

Mr Ohm says materials listings dominated the market again, with 63 new market entrants in the year compared to 107 in 2021.

"Gold and battery metals, in particular lithium, have been popular commodities for exploration listings this year," he says.

The report also found new listings struggled to meet subscription targets during the year, with only 70 per cent successfully raising the intended amount. That's compared with 87 per cent of listings meeting their targets in 2021.

IPO Watch Australia expects the slowdown in IPO activity to continue into 2023.

"Against the backdrop of rising interest rates, rising inflation and geopolitical uncertainty, there was a significant decrease in the number of IPOs in the second half of 2022, notably in the technology sector," IPO Watch Australia Partner Nicholas Guest notes in the report.

Add Category

Add Category