The US-listed shares of Alibaba Group jumped 14.3% on Tuesday (local time) after the company announced plans to split its business into six divisions, covering online shopping, media and the cloud.

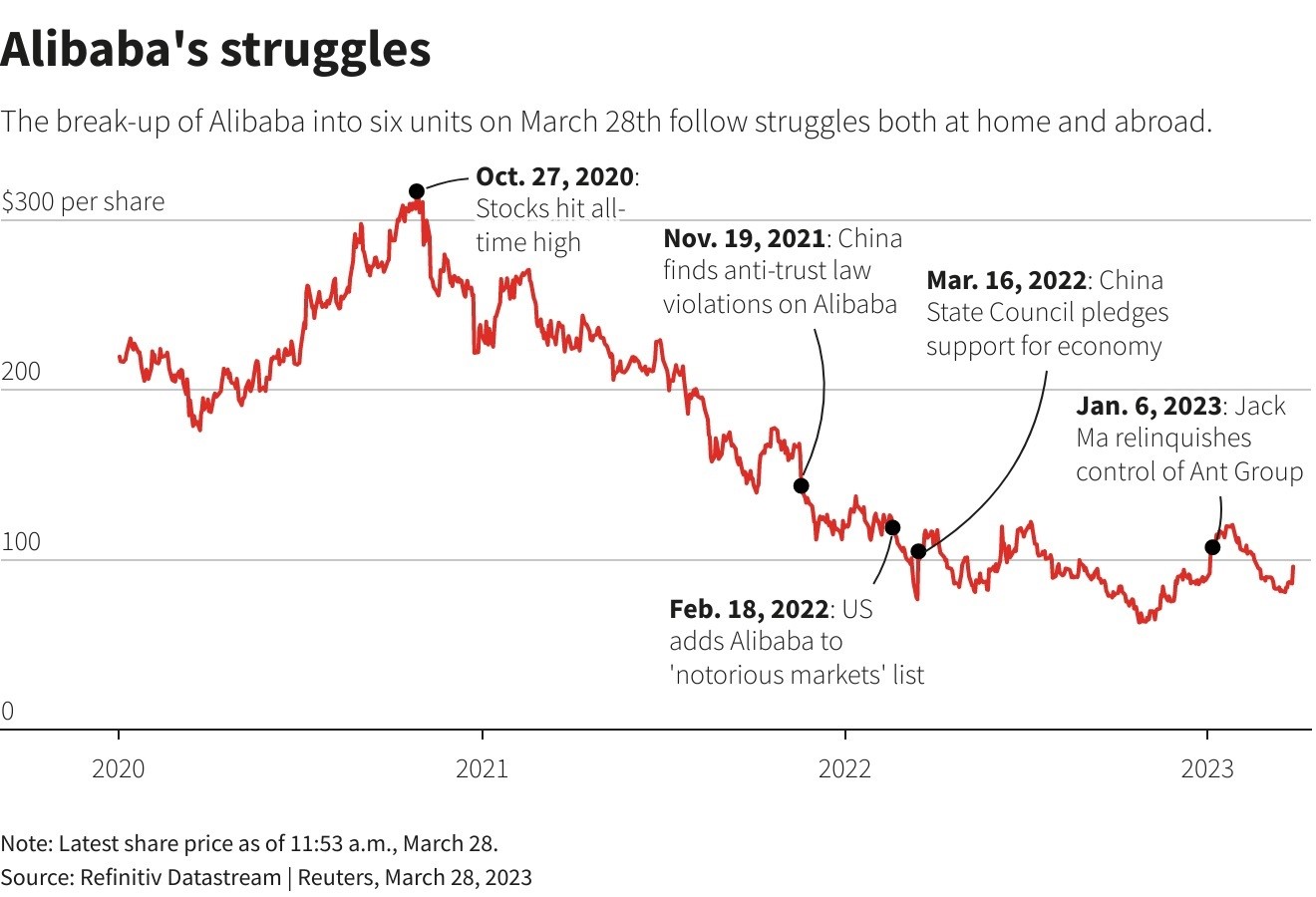

But that was after the Chinese e-commerce giant suffered a 70% plunge in its share price in the past couple of years.

Alibaba said the biggest restructuring in its 24-year history would see it split into six units - Cloud Intelligence Group, Taobao Tmall Commerce Group, Local Services Group, Cainiao Smart Logistics Group, Global Digital Commerce Group and Digital Media and Entertainment Group.

The revamp comes a day after Alibaba's billionaire founder Jack Ma returned home from a year-long stay abroad.

It's a move that coincided with Beijing's effort to spur growth in the private sector - following a two-year crackdown on the technology sector.

Analysts said the breakup could ease scrutiny over the tech giant whose sprawling business has been a target of regulators for years.

Each of the six businesses will have a CEO as well as a board of directors and will retain the flexibility to raise outside capital and seek an initial public offering.

The exception would be Taobao Tmall Commerce Group that handles China commerce businesses and will remain a wholly owned unit of Alibaba Group.

'Less hostility' towards tech giants

Investors said the split signals the clearing of regulatory worries and allays concerns that Alibaba had lost the potential to grow.

The decision could also be partly a fallout of the US scrutiny of Chinese tech firms that raised national security concerns over TikTok and its parent ByteDance, said Tara Hariharan, the head of global macro research at NWI Management.

"By paving the way for Alibaba's various new units to list, the Chinese government may be signalling less hostility towards its tech giants as a placatory message to US and international investors," she added.

The restructuring is among the biggest corporate moves by a major Chinese tech company in recent years, as the industry cowered under tighter regulatory oversight, causing deals to dry up and dampening risk appetite among businesses.

Lately, authorities have been softening their tone towards the private sector as leaders try to shore up an economy battered by three years of strict COVID-19 curbs.

Companies, however, have been hesitant, privately pointing to a lack of new supportive policies and the new regulatory framework.

Alibaba's shares had received a boost on Monday after its founder Jack Ma returned to China as his overseas stay was viewed by the industry as a reflection of the sober mood of its private businesses.

Add Category

Add Category