A couple of interesting notes out today from real estate analysis firm CoreLogic.

One is from Kaytlin Ezzy about the state of the major regional property markets, only seven of which are worth more now than they were a year ago.

The South East region in SA, which includes Kangaroo Island, the Fleurieu Peninsula and the Limestone Coast, remained the best performing regional house market on an annual basis, up 10.8%.

The New England and North West (NSW) and Bunbury (WA) regions were the next best performers, up 4.9% and 4.8% respectively.

In contrast, NSW lifestyle markets, including the Richmond-Tweed (-24.2%), Southern Highlands and Shoalhaven (-16.0%) and Illawarra (-13.7%) regions recorded the largest annual declines in house values, according to CoreLogic's data.

But all of these areas had huge price gains during the pandemic, with Richmond-Tweed up 51% for example.

"Over the past year, premium lifestyle markets have been hardest hit by softer market conditions and rate increases," Ms Ezzy noted.

"These markets were among the largest beneficiaries of regional migration through the COVID-induced upswing and, as a result, became significantly more sensitive to the rising cost of debt and the normalisation in regional migration trends."

The other note, from CoreLogic's head of research in Australia, Eliza Owen, looks at the number of property listings and whether they're likely to go up.

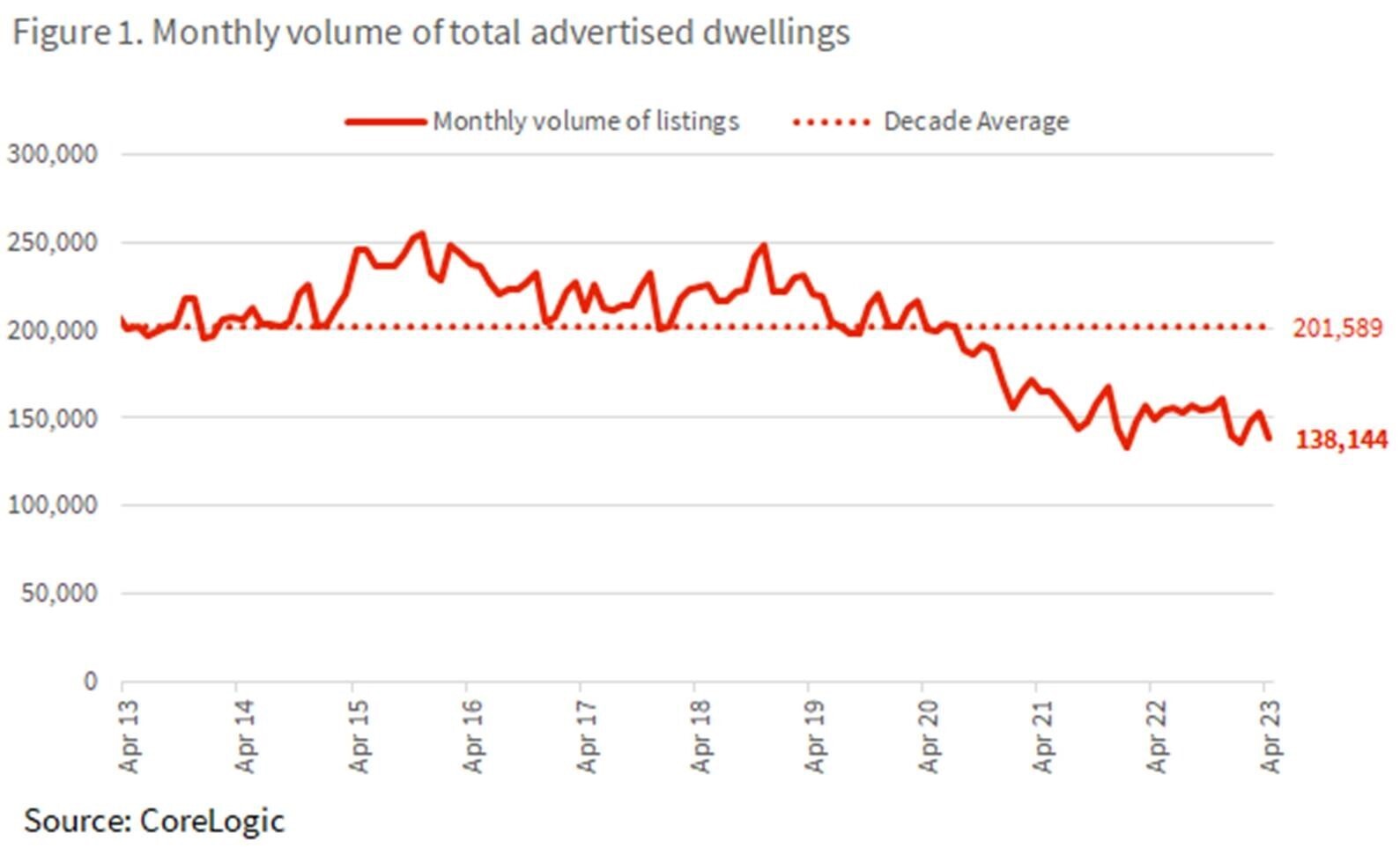

At the moment, listings are close to the lowest they've been over the past decade.

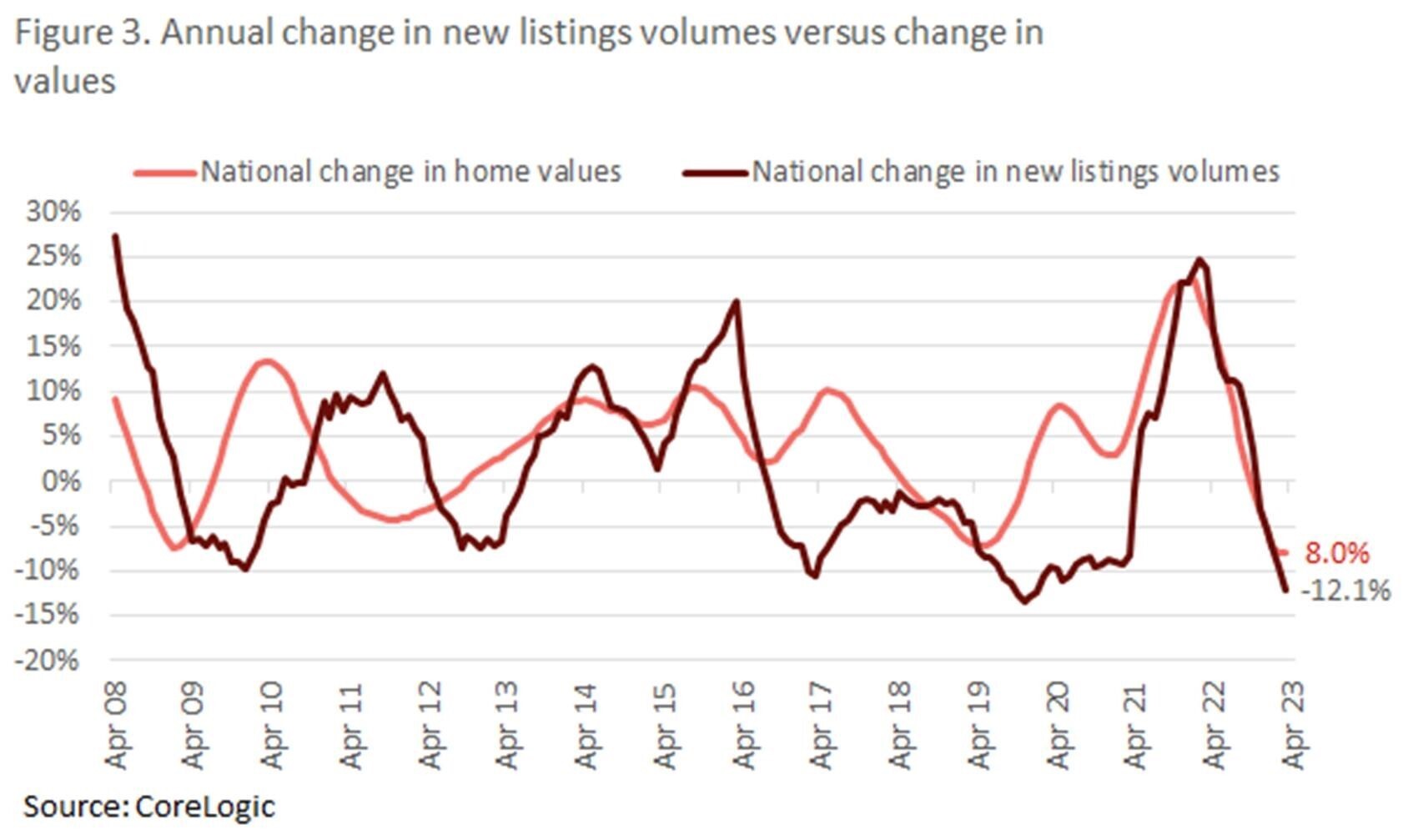

However, listings are closely correlated with prices — when prices are rising, owners seem more willing to sell, says Ms Owen. Also, as listings peak it tends to drive prices down and when listings are low it can help hold prices up.

"Simple linear regression analysis suggests that for every 1% increase in property values over the year, there is a 0.5% increase in new listings in the same period," she observed.

"Going by the historic average, if national home values continue on the current trajectory through to the end of the year, that is rising at half a per cent per month (as recorded in March and April), home values would end the year around 4.1% higher.

"This would equate to an increase in 2023 listings that was 2% higher when compared to 2022. An additional 2% on the 485,052 new listings over 2022, would equate to 494,753 listings over 2023."

Ms Owen says there's no certainty price growth will continue at the current pace, after this month's surprise rate hike with the threat of more to possibly follow.

However, she adds that rising rates could see more properties listed for sale later this year, even if prices stall or fall again.

"Alternatively, there is a scenario that presents an upside risk for new listings. This would be a situation where vendors may need to sell their home and not voluntarily," she wrote.

"This may include households struggling to service a mortgage at higher interest rates, particularly amid rising unemployment over the course of the year.

"However, this scenario seems unlikely at present, given the low volume of new listings to date through rate rises, and strong pre-payment buffers across mortgaged households."

Add Category

Add Category