Many borrowers are feeling the pinch, with the Reserve Bank's cash rate having rising 11 times over the past year, from 0.1 to 3.85%.

Market pricing and economic consensus generally has the cash rate starting to fall from that peak sometime later this year or early next.

But new research from Marcel Thieliant at Capital Economics suggests that borrowers shouldn't count on rates falling too far from current levels for too long.

He finds that the cash rate is likely to average 3.5% in the longer term, an estimate that broadly tallies with previous statements by RBA officials, such as governor Philip Lowe.

The "neutral" interest rate is one that economists believe neither adds to or subtracts from demand in the economy or, as Mr Thieliant puts it:

"The neutral interest rate is the rate that allows economic activity to evolve in line with its potential and therefore ensures that inflation settles around the central bank’s target."

Mr Thieliant says his current estimates put that at around 0.5% in real terms, that is excluding the effects of inflation.

When you add in the RBA's targeted 2-3% level of inflation, that leaves the current 'nominal' neutral interest rate around 3%.

But Mr Thieliant expects that to rise to around 3.5% by 2050 as the real neutral cash rate edges up to 1%.

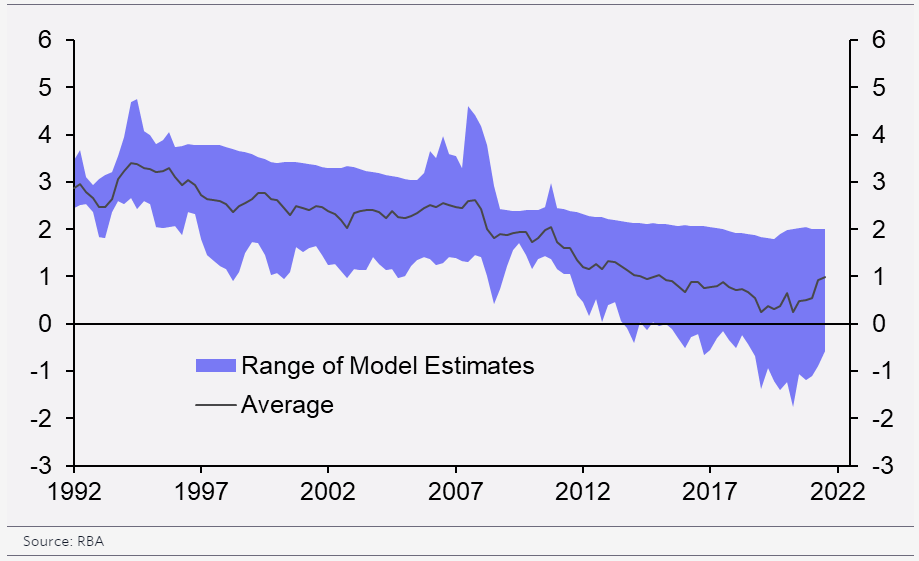

Given that the estimates for the real neutral interest rate are driven by econometric modelling, the results vary somewhat based on the data and assumptions used.

The RBA seems to think the real interest rate is already at least 1%, according to Mr Thieliant.

"The RBA estimated last year that the real neutral policy rate fell from around 3% in the early 1990s to just above 0% before the pandemic, though the RBA estimates that it has since edged up to around 1%," he observed.

"Documents that the RBA was forced to release in response to a Freedom of Information request show that RBA staff now think that the nominal neutral rate is nearly 4%, which implies a real neutral rate closer to 1.5%."

The good news from a rising neutral interest rate is that it is an indication the economy might escape the low-growth funk it has been in for the past decade or so.

"Arguably the main reason why the real interest rate has fallen in recent decades is the decline in potential GDP growth across advanced economies," Mr Thieliant wrote.

"According to OECD estimates, potential GDP growth in Australia slowed from 3.3% in the 1990s to only 1.7% on the eve of the pandemic. That matters because lower potential growth reduces the future returns on capital and therefore reduces investment demand."

Stronger economic growth, if distributed widely across the population, means that most borrowers should be able to cope with those slightly higher long-term interest rates.

Add Category

Add Category