Fitch Ratings has revised its outlook for the banking sectors in Australia and New Zealand from "neutral" to "deteriorating."

It says the downgrades reflect the greater headwinds against bank earnings and asset quality that it was expecting in the second half of 2023.

"The adjustment in the banking sector outlooks has not been driven by major revisions to our baseline assumptions, but rather the greater impact that weakening economic activity will have on bank credit metrics in the second half of the year," they say.

"That said, we have modestly revised down our 2023 economic growth forecast for New Zealand, to 0.8% at present, from 1% in December 2022. Our forecast for Australia remains unchanged at 1.5%.

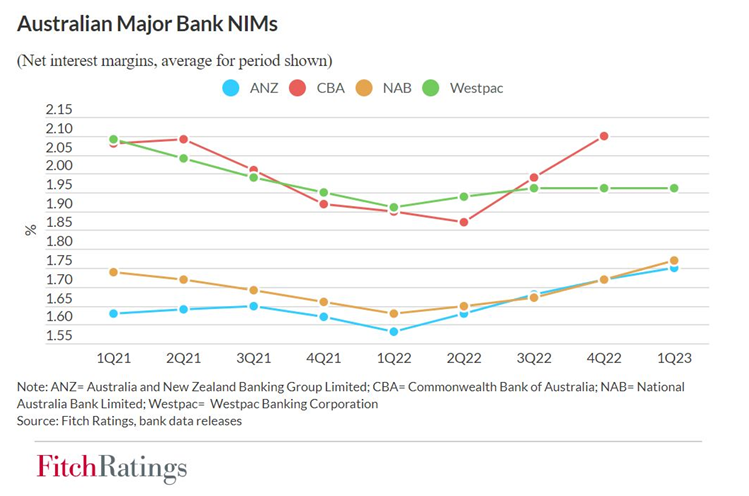

"In Australia, we see net interest margins (NIMs) as having peaked late last year.

"The interest rate hike cycle appears close to its end. NIMs benefited from a strong uplift in the current cycle, as high inflation led to a relatively fast and steep rise in rates, while savings buffers built up during the Covid-19 pandemic initially dampened deposit pricing.

"However, we believe that these effects are gradually dissipating and we expect stronger competition for loans and, increasingly, deposits, to pressure NIMs through 2H23.

"At the same time, we forecast loan growth in Australia to slow, particularly in mortgages, as higher rates deter new borrowers, and impairment charges to rise from still-low levels as arrears pick up.

"Higher rates will cause asset quality to weaken in both the commercial and mortgage books, albeit from very strong levels and not to a degree that would pressure bank ratings under our baseline assumptions.

"Negative equity levels remain low – the Reserve Bank of Australia projects they will rise to just 2% even if house prices fell by a further 10% from January 2023 levels – reducing the risk of bank losses."

Add Category

Add Category