Households in some regions are feeling the pinch of rising interest rates more than others, and CoreLogic has taken a look at where those areas are located.

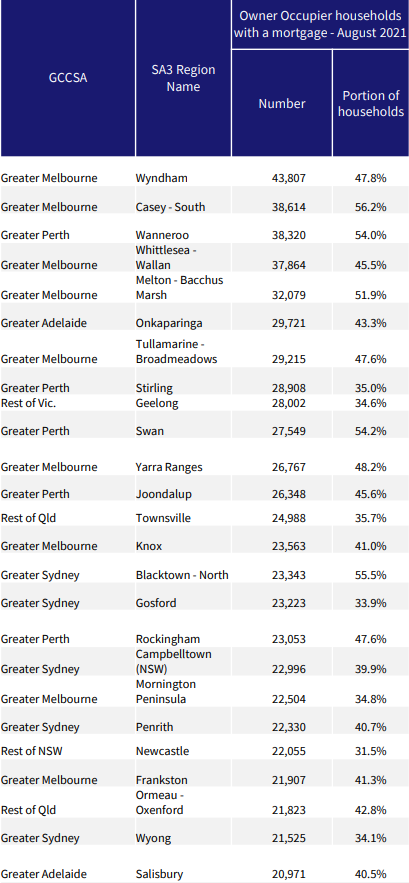

The firm's head of Australian research Eliza Owen says the number of mortgaged, owner-occupier households are generally highest in outer regions of major cities, particularly Melbourne.

Here's the 25 most mortgaged areas:

"For markets in the capital city regions, there is an average distance to the city centre of about 34 km," Ms Owen writes.

"As of the 2021 Census, median weekly household incomes across these markets had a sizable range, from $2,722 per week across Blacktown – North in Sydney, to $1,364 in Salisbury in Greater Adelaide.

"However, 16 of the 25 regions had a median weekly household income that was lower than the respective greater capital city or region."

While the number of new property listings is generally lower across the country over the past few weeks, in line a typical slowdown in winter, listings have risen in nearly half of the most mortgaged areas.

"It is noticeable that new listings volumes are climbing in some of these markets, where the national trend is seeing a seasonal slowdown.

"Across the Blacktown – North market, new listings have increased from 185 in the four weeks to May 2023, to 230 in the past four weeks," Ms Owen notes.

"Total listings are still low relative to where they have been in the past five years, but the monthly median time on market across Blacktown – North has been rising since February, which may lead to an accumulation of total stock as interest rates continue to climb and buyer uncertainty increases."

It's worth noting, however, that the mortgage data used from the Census doesn't capture features such as home loan size or how long households have had the loans, or how easily they are able to service them.

Add Category

Add Category