I don’t have a view on whether the modern trend of central bankers talking more in public is making it easier or harder for them to do their job? I do have a view on inflation, which is we need to get it under control NOW. I’m fed up with the RBA tiptoeing around the issue, whilst my groceries and bills seem to get more expensive each week.

- Billy Brown

Thanks Billy,

Completely understand your point. I'm absolutely sick of the prices we're seeing in supermarkets too. $10 for cheese. $3 for 10 tea bags. It's a joke. I'm living on water and bread these days.

But ANZ senior economist Blair Chapman circulated an interesting note yesterday that had some good insights, which are worth keeping in mind (when it comes to the RBA's attempts to get inflation down).

He said RBA deputy governor Hauser recently asked do you strip out administered prices and control the things you can control, or “do you have to push the rest of the inflation basket down a little bit further in order to bring inflation back to target?”

That was an important question.

Mr Chapman then provided some data around that question.

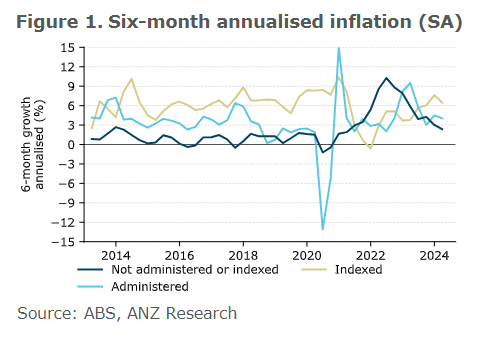

"Non-administered and non-indexed inflation has declined notably and is running around levels consistent with the RBA’s target band on a six-month annualised basis, noting that headline inflation averaged below target (1.9% y/y)between 2013 and 2019 (Figure 1)," he wrote.

"In contrast, inflation on indexed items has accelerated over the past year and inflation on administered goods & services has picked up on a six-month annualised basis (despite slowing on an annual basis). This is contributing to the higher inflation pulse we’ve seen this year.

He went on:

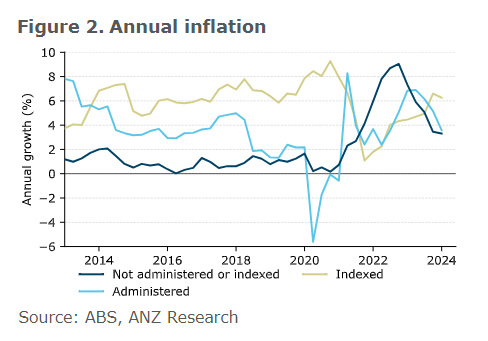

"Prices for non-administered and non-indexed items grew 3.3% y/y to Q1 2024, down from a peak of 9.0% y/y. Seasonally adjusted non-administered and non-indexed inflation over the two quarters to Q1 2024 annualised was 2.4%, around the level needed for the RBA to hit the midpoint of its target band if indexed and administered prices grow at or near their pre-COVID rates.

"Inflation on indexed items ran above the RBA’s target band for most of the decade pre-COVID, while administered prices tended to run above the band until 2018 (Figure 2).

"As Figure 2 also shows, the current pace of indexed and administered inflation is not materially different than before COVID.

Mr Chapman said the RBA can do little to influence inflation on indexed or administered goods and services without long lags.

"For example, university fees are indexed to December a year ago (not the most recent December)," he said.

"The RBA could raise the cash rate to slow inflation more sharply across the rest of the CPI basket, offsetting higher administered and indexed inflation,and bringing headline inflation back into the target band sooner.

"But this would likely slow activity in interest rate sensitive sectors, slow employment growth and add to unemployment.

"In response to Deputy Governor Hauser’s question, we think the RBA will look through some of the inflation it can’t “control” even if the Q2 CPI prints a little above the RBA’s forecasts and see the Board holding the cash rate steady at 4.35% at its August meeting."

Add Category

Add Category