Well, it's been a comfortable ride today, certainly compared to this time last week when everything was crashing around this blog's very existence — the ASX was down almost 4%, the Nikkei was down 10% and the S&P500 futures were pricing in another harrowing session.

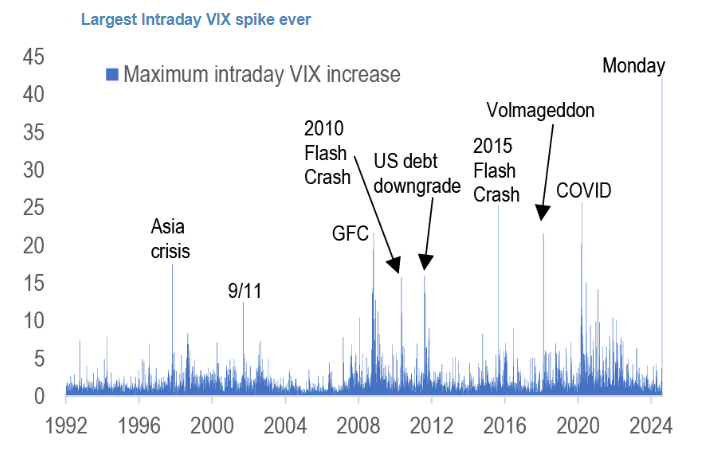

The so-called "fear index", the VIX, spiked to its highest-ever reading last Monday, higher than anything seen in the GFC, the US debt downgrade, the infamous 2015 flash crash and 2018 Volmagddon crash.

Volmageddon is instructive about how markets misjudge risk and volatility and how complacency can be a wealth killer.

Back in 2018 things were calm on the markets, so calm that a massive amount of money had been pumped into inverse VIX ETFs, effectively betting that things would stay calm.

They didn't and the S&P 500 tumbled 10% in ensuing weeks and the inverse VIX ETFs accelerated things.

While VIX has calmed down for the moment, it remains at relatively high levels.

So, could it pop again? You bet it could.

JP Morgan's chief global economist and head of economic research, Bruce Kasman, noted over the weekend the market had "moved outside of the range where option-based ETFs materially suppress volatility and into a range where option hedging activity is boosting realized volatility".

"The negative relationship between volatility and liquidity is 'particularly potent' during times of elevated volatility and such confluence often 'creates self-amplifying feedback loops of lower liquidity-higher volatility-systematic outflows' (i.e. market fragility)."

Those self-amplifying feedback loops were very much in play during Volmageddon.

Mr Kasman's colleague and head of Global Equity Strategy Mislav Matjeka warned investors still weren't pricing in the inherent dangers at the moment.

"The investor outlook is still overly complacent, concentration risk remains high, Vix has not had a proper capitulation for a while, and credit spreads are extremely tight.

"We continue to believe that International equities will be weakening during summer, and SPX (the S&P500) as well should be under pressure."

Add Category

Add Category