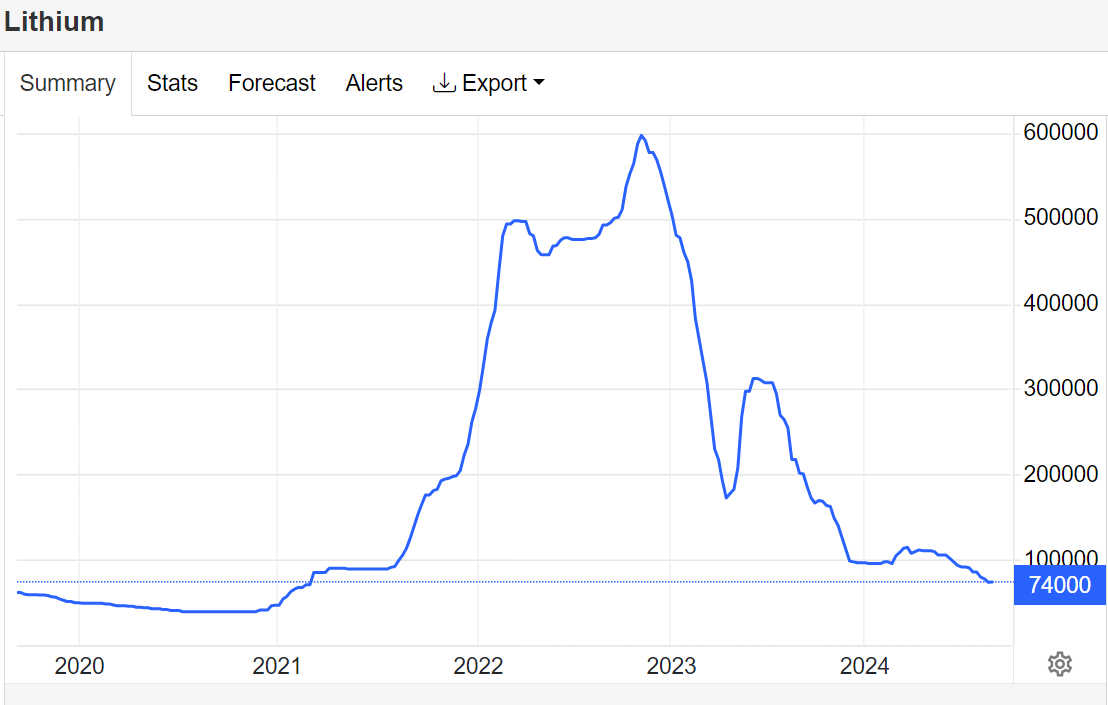

It is probably worth a deeper dive into the lithium market on the back of Pilbara Minerals' 86% profit dive announced this morning.

Pilbara is Australia's largest "pure play" lithium miner.

Its full year profit was crushed on the back of slump in demand, driving down the average realised price for lithium raw material spodumene concentrate by 74% to $US1,176 per tonne over the past year.

But research out this morning from UBS says things are likely to get much worse before they get better.

The current spot spodumene price is about $US770/tonne and UBS forecasts that is about the level it will sit for the next 12 to 18 months at least.

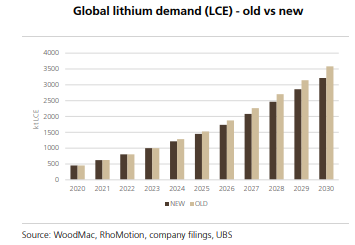

The forecast comes following downward revisions from the UBS global auto and EV team on the industry's outlook.

"With global automotive battery demand now up to 10% lower through to 2030 — partly as a result of ~10% higher PHEV (plug-in hybrid) share across the same period, and partly reflecting lower outright EV demand — this has a similar impact for lithium demand," UBS mining analyst Lachlan Shaw wrote in a note to clients.

The UBS analysis finds that apart from the decline of passenger light EV demand, there is falling EV market penetration, particularly out of the US on waning sentiment and presidential election risks, and an increasing plug-in hybrid share, which results in lower average battery sizes.

"Together, these changes result in global lithium demand down ~10% to 2030," Mr Shaw said.

While lithium demand is falling, supply looks to be increasing, at least in the foreseeable future.

"While we don't observe any large-scale curtailments (yet), it is clear that the stress of low prices needs to drive production curtailment and delay/deferral of growth projects," Mr Shaw said.

To an extent, lithium's collapsing fortunes have been baked into Pilbara's value already with shares barely moving on today's results release, trading at $2.98 at 2pm AEST.

Still, UBS has cut its price target for Pilbara from $2.50 to $2.30. maintaining a sell recommendation.

Mineral Resources, which also mines lower grade iron ore in WA, has seen its price target cut by 20% from $54.00 to $43.00 on UBS's modelling.

Add Category

Add Category