Against the overall risk-off trend prompted by Friday's Wall Street sell-off, and another substantial decline in iron ore prices to end last week, Australia's miners have bounced back solidly today.

The ASX 300 mining index is up around 1.3%.

All the big iron miners are back in demand, and the diversified South 32 which digs up and processes bauxite, manganese, copper, silver and other metals, is up a very healthy 5.5% today.

So, what's up, given the overall trend on the mining index has been down - 5% for the month and 16% year-to-date.

Well aluminium for one thing, it jumped more than 5% on Friday which helps South 32 and the local listing of Alcoa, which is up 5.9% (a shout out to James who wanted to know what was happening with South 32).

But from a broader perspective, CBA's commodities economist Vivek Dhar says the market has spotted some green shoots in China's recent data, much of which was released late on Friday and over the weekend.

At first glance, much of the data didn't look great.

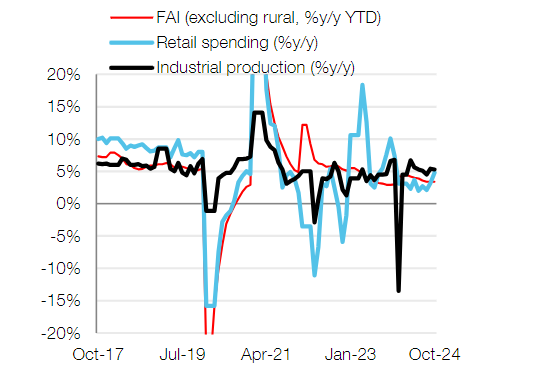

Chinese industrial production growth slowed slightly from 5.4% YoY in September to 5.3% in October.

Fixed asset investment, a proxy for construction and infrastructure spending, slowed in seasonally adjusted terms, but was in line with consensus thinking.

Retail spending rose 4.8% YoY in October, but in seasonally adjusted terms growth slowed there too.

Mr Dhar said the larger than expected uptick in China's retail sales indicate that subsidies to help consumer purchases of equipment, appliances and cars may be working.

But he cautioned it's far too early to conclude though that China's attempts to rebalance the economy towards consumption have proven successful.

Property data released on Saturday also had a glimmer of good news.

"While new home property prices across 70 cities in China fell again on average for the 17th consecutive month last month, the pace of contraction was the lowest since March 2024," Mr Dhar noted.

The annual pace of contraction in floor space sales, in square metres, also eased considerably from 11%/yr in September to 2%/yr in October.

"However, these green shoots do little to change the narrative that China's property sector still needs significant support to stabilise," Mr Dhar said.

The third green shoot Mr Dhar spotted was infrastructure investment, which accelerated from 1.0% MoM (seasonally adjusted) in September to 1.7% in October marking the largest expansion since November 2023.

"The government's debt swap program should see infrastructure spending supported for the remainder of the year.

"We continue to see infrastructure spending as the best chance for China's economy to reach its growth target of 'around 5%' this year.

"China's economy needs to accelerate from 4.6% in Q3 2024 to ~5.4% in Q4 2024 for the economy to grow 5% in 2024.

"We see policymakers deploying more stimulus next year, especially if Trump's promised tariffs are implemented in full."